7 Things to Know about Accounting when Starting a Business Lassonde Entrepreneur Institute University of Utah

Content

The financial statements and information are also required for indirect and direct tax filing purposes. Accounting helps business owners prepare historic financial records as well as financial projections which can be used while applying for a loan or securing investment for the business. Using the accounting reports, business owners can determine how well a business is performing. The financial reports are a reliable source of measuring the key performance indicators, so business owners can compare themselves against their past performance as well as against the competitors. The main objective of accounting is to record financial transactions in the books of accounts to identify, measure and communicate economic information.

Professional accountants assist business owners in making smart fiscal decisions while adhering to the compliance requirements. The six components of an AIS all work together to help key employees collect, store, manage, process, retrieve, and report financial data. Having a well-developed and maintained accounting information system that is efficient and accurate is an indispensable component of a successful business. They are any of the software tools that relate to the objectives of collecting, storing, processing, and distributing financial data. These can include invoicing, payment processing, and accounting software, as well as reporting and payroll/time-tracking software. The accounting standards are important because they allow all stakeholders and shareholders to easily understand and interpret the reported financial statements from year to year.

Characteristics of a healthy Organization

Your financial and economic decisions as a student and consumer involve accounting information. When you file income tax returns, accounting information helps determine your taxes payable. Bank and financial institutions that provide loan to the business are interested to know credit-worthiness of the business. The groups, who lend money need accounting information to analyses a company’s profitability, liquidity and financial position before making a loan to the company. Further, they keep constant watch on the operating results and financial position of the business through accounting data. Investors, lenders, and other creditors are the primary external users of accounting information.

Financial transactions from the business operations and financial transactions regarding company assets are all recorded and presented by internal accountants. Executive management needs accurate financial information for several reasons, including planning, decision making, and profitability reporting. A company needs financial accounting information for various reasons, but mainly to ensure the company’s financial health remains intact. Accounting is important for small business owners as it helps the owners, managers, investors and other stakeholders in the business evaluate the financial performance of the business. Accounting provides vital information regarding cost and earnings, profit and loss, liabilities and assets for decision making, planning and controlling processes within a business.

Tax Accounting

These costs can be compared to the potential income of new opportunities during the financial analysis process. This process helps business owners understand how current business operations will be affected when expanding or growing their businesses. Opportunities with low income potential and high costs are often rejected by business owners. Business owners often use accounting information to create budgets for their companies.

- When signing a contract with a second company, financial statements become a key aspect of deciding which company to work for.

- Accountants reduce uncertainty by using professional judgment to quantify the future financial impact of taking action or delaying action.

- An organization’s financial records are a reflection of its health.

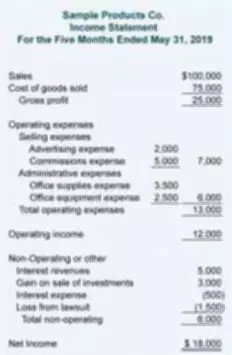

- The financial statements include the income statement, the balance sheet, the cash flow statement, and the statement of retained earnings.

- Poor financial management is one of the primary reasons for small business failure especially in the first year of the business.

Similarly, share option schemes also encourage employees to be interested in how well a business is performing as it can affect the value of their share options. Employees need accounting information for assessing their job security, negotiating their remuneration, as well as in the performance of work-related tasks. Their investigation led to the termination of CFO Scott Sullivan, as well as new legislation—section 404 of the Sarbanes-Oxley Act.

International standardization agencies

Depending on your business and circumstances, you might prefer one method for filing income taxes over another. You may want to consider this when deciding what type of entity to form. You will also want to consult an attorney to consider legal implications of each entity type, since tax implications aren’t the only things you should consider when choosing a business type. You will be doing yourself a favor if you think about all of these things before your company grows and becomes more complicated. You may not use a balance sheet much in the beginning, but it will eventually become very important as banks and investors often require them when reviewing your business.

You won’t find this kind of customization in generic accounting software packages. The accountant may generate additional reports for special purposes, such as determining the profit on sale of a product, or the revenues generated from a particular sales region. These are usually considered to be managerial reports, rather than the financial reports issued to outsiders. AIS software programs can be customized to meet the unique needs of different types of businesses. If an existing program does not meet a company’s needs, the necessary software can be developed in-house with substantial input from end-users.

(A) Internal Users:

Banks, lenders, venture capitalists or private investors often review a company’s accounting information to review its financial health and operational profitability. This provides information about whether or not a small business is a wise investment decision. As a small business owner, it might be tempting to manage the business finances yourself, but financial matters can be delicate and may require a trained professional to handle them correctly.

- Managers and employees require accounting information of their work organization for personal and professional reasons that are summarized in the infographic below.

- Law requires businesses to maintain an accurate financial record of their transactions and share the reports with the shareholders, tax authorities and regulators.

- Don’t wait, because you will regret it when you eventually need these records, and you are forced to find records and information that is no longer easy to get, Christenson said.

- Legacy systems are often in existing business firms and were used before information technology got as sophisticated as it is today.

- A common use of accounting information is measuring the performance of various business operations.

Accounting information is valuable to both groups when it comes time to evaluate the financial consequences of various alternatives. Accountants reduce uncertainty by using professional judgment to quantify the future financial impact of taking action or delaying action. In short, although accounting information plays a significant role in reducing uncertainty within an organization, it also provides financial data for persons outside the company. Managerial accounting information is for internal use and provides special information for the managers of a company. The information managers use may range from broad, long-range planning data to detailed explanations of why actual costs varied from cost estimates.

The 5 M’s Of Business Management: Organising Them Effectively

Even the smallest businesses may choose to use systems like Quickbooks. Accounting information systems collect and process transaction data and communicate the financial information to interested parties. There are many types of accounting information systems and, as a result, they vary greatly. A number of factors influence these systems such as the type and size of the business, the volume of data, the type of data management needs, and other factors. Without reliable accounting data, management cannot accurately estimate the relevant cost and benefit of business decisions. Generally, businesses are more likely to lay off workers during times of recession to minimize their fixed costs.

SQL allows the data that’s in the AIS to be manipulated and retrieved for reporting purposes. If you get audited by the IRS, they will want to see receipts, not your Excel file. Christenson recommended that businesses keep their receipts until the statute of limitations on your tax return has expired, then it’s probably safe to toss them for tax purposes.

The four largest accounting firms globally include Deloitte, KPMG, PwC, and EY. Investors provide the capital needed for the company to start and continue functioning. Before someone decides to invest any amount of capital into a https://www.bookstime.com/ company, they have an obligation to review all financial documents produced by the company and see if their investment is secure. In addition to helping you manage your business, a budget and forecast can help you get funding.

A carefully prepared budget can be extremely helpful as grow your company. Look at your budget and start tweaking things to see what difference it makes. Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Accountants https://www.bookstime.com/articles/business-accounting provide relevant accounting information to the public, which enables them to identify financial irregularities and therefore prevent and detect corruption. In addition to keeping detailed records, you may need to follow a set rulebook for accounting, known as generally accepted accounting principles (GAAP).